Many college students—myself included—rely on federal student aid to afford the cost of attending college, which we get through the Free Application for Federal Student Aid. Passed in December 2021, the FAFSA Simplification Act amended several parts of the 2024-2025 FAFSA—including pushing back the date the form was released. Many students have felt lost and worried about how the delays and changes caused by the act will affect the federal aid they will be able to receive this coming school year. I think there are good and bad aspects of these alterations, but overall, these changes have caused more problems than they have solved.

FAFSA became available to students on Dec. 31 and the deadline for full consideration for federal aid is June 30, according to the United States Department of Education. The State of Indiana’s deadlines are “as soon as possible” for some awards or “April 15, 2024, midnight Central time (CT)” for others, per StudentAid.gov. The release date was months later than it used to be (the FAFSA is typically released in October of the year before the next school year starts) which left many students to wonder when they would be able to apply for aid or what the changes would mean to them. For me, this was a source of anxiety. Without federal student aid, I would certainly struggle to afford tuition at the University of Indianapolis. While this later roll-out was inconvenient and anxiety-inducing, this is one of the more minor issues I have found with the new FAFSA. The pushed-back start time also likely has an impact on students who are deciding which college to attend in the fall of 2024. Cost is typically a large factor when a student is deciding where to go (it certainly was for me), and if they do not know how much federal aid they will receive, they may not be able to estimate or compare the affordability of different universities. In addition, many colleges gauge students’ financial aid based on data from the FAFSA—How are colleges and students supposed to have everything all figured out by when college applications are due?

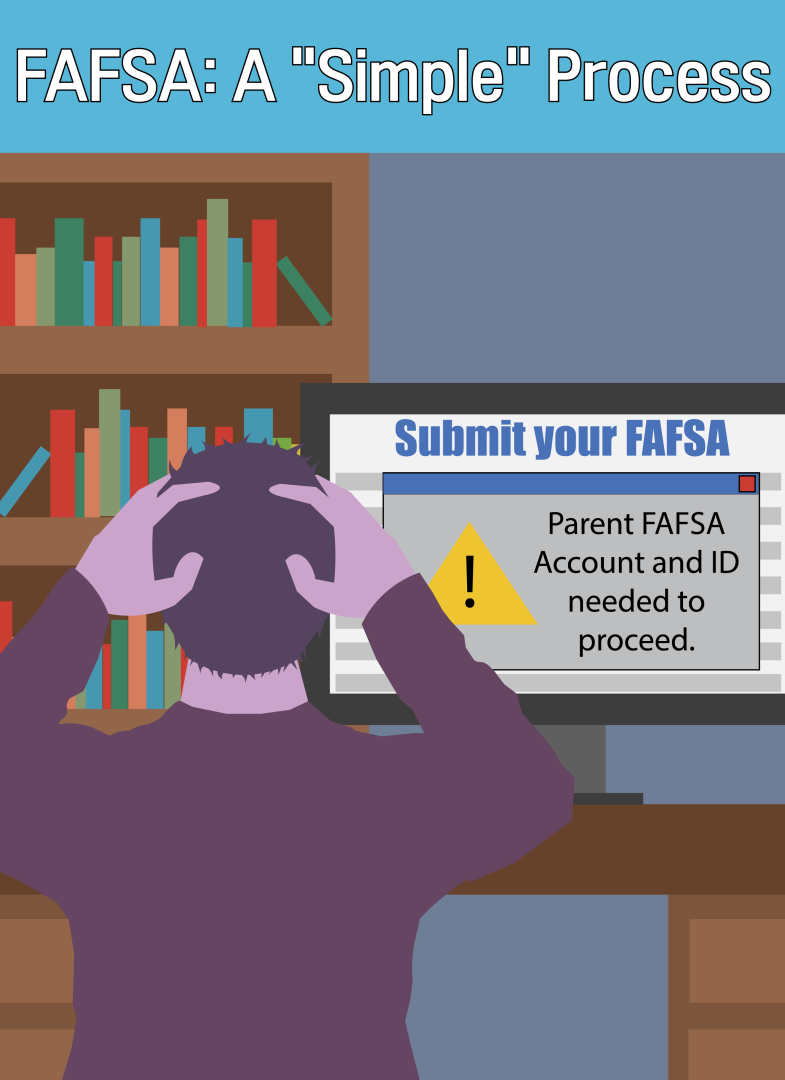

One of the more controversial changes to the FAFSA is that every “contributor” needs to have a Federal Student Aid (FSA) ID and has to fill out their income information individually. A contributor includes the student or the student’s spouse, one or both biological parents or one or both adoptive parents, depending on the student’s state of dependency and their or their parents’ tax filing information. The reason many students, myself included, find problems with this change is the complications that come with requiring multiple different people to input their information. For me, getting both my parents and myself to have the free time to fill this confusing government form out is not an easy task. Previously, I could fill this information out myself and only ask my parents questions as needed which was a much easier process. The reason for this, according to the U.S. Department of Education, is to streamline the FAFSA process, as each contributor will have their income information input directly from the IRS, which was made possible through the Fostering Undergraduate Talent by Unlocking Resources for Education Act. I understand that the main goal of the FAFSA Simplification Act was to make FAFSA an easier process, but I think most of the changes have done the opposite and made it much more difficult.

One of the biggest factors that will likely affect me is the 2024-25 FAFSA no longer takes into consideration whether a family has more than one child attending college at the same time. I have a twin brother who is attending Vincennes University and we each pay our own tuition. FAFSA has always primarily based financial aid on the income of parents of dependent students, although many college students pay their own tuition. For me, especially with this change, it is likely that I will receive less federal aid because FAFSA no longer considers that, theoretically, my parents’ income would be affected by two students in college at the same time. This is one of the changes that I am most unhappy with because I fail to see how this would benefit anyone applying for federal aid.

One change that will be a potential benefit for students is the expansion of Federal Pell Grants. According to the U.S. Department of Education, the new FAFSA will link Pell Grant eligibility to family size and the poverty level. Students who are incarcerated will also gain eligibility for these grants. The latter does not affect me, and only a matter of time will show whether the former does, but I think these changes have the least negative impact on students applying for federal aid. Overall, I am not happy with the changes that have been made to FAFSA. Not only will the lack of consideration for families with multiple kids in college affect the amount of aid I will likely receive, but the process hardly seems streamlined to me, which was one of the primary goals of the FAFSA Simplification Act. And, to top off all of the chaos even moreso, a calculation error by the Department of Education will delay FAFSAs from being sent out to institutions until at least March, according to NBC News. I guess students have two options now—bury themselves in more debt to afford tuition or pray the Department of Education can get their act together.