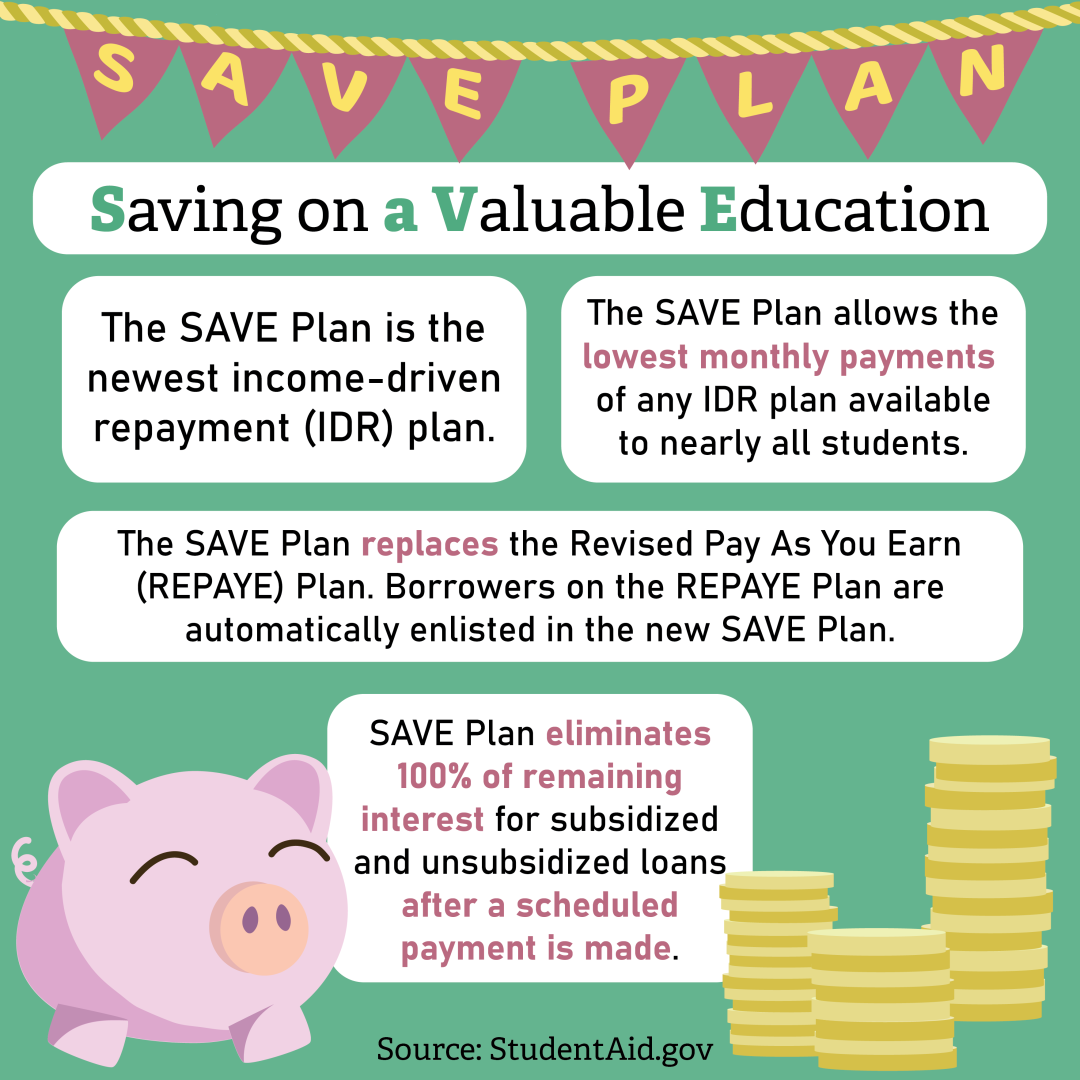

The Saving on a Valuable Education Plan was announced by the Biden administration this past August and is an income-based loan repayment plan that will reduce the size and interest of loan payments for students whose income is below a certain level. According to Federal Student Aid, not only will this plan reduce the size of payments, but it will also reduce the impact of interest of low-income Americans and will reduce the amount of time people will be paying their loans. According to Federal Student Aid, the proposed plan will go into effect for most Americans in the summer of 2024, for those who qualify by earning below the income amount, it could go into effect now.

During the COVID-19 pandemic, the Biden administration paused the payment of student loans at a time when most people were struggling economically according to a fact sheet from The White House.

Associate Professor of Political Science Greg Shufeldt said that originally Biden agreed to wipe out $10,000 for most Americans and $20,000 for those in extreme poverty. Ultimately, the Supreme Court rejected this plan, ruling that this was not constitutionally within the president’s power. According to Shufeldt, a lot of people disagreed with this, calling into account the ‘Heroes Act’ which gave the Secretary of Education the power to waive or modify student loan payments during times of distress. The Biden administration proposed the SAVE plan as a backup option to the original plan. Shufeldt said although the SAVE plan is not as generous, it still has the goal of reducing the overall pressure that student loan payment can cause.

“Initially, the Biden administration proposed doing a very broad student loan forgiveness. For some people this was as much as $10,000 being just completely forgiven from their student loans. For some Americans this was up to $20,000,” Shufeldt said. “This was going to be a really big effort to reduce the amount of student loan payments that people have and the Supreme Court struck that down. They said it was unconstitutional that the president didn’t have the authority to do this. So [the SAVE plan] is kind of, ‘You wouldn’t let us do this, here’s this other thing that we can try to do to reduce the burden of student loan payments that Americans feel.’”

When the SAVE plan goes into effect next year, it will replace the current Revised Pay As You Earn plan, according to Federal Student Aid. Shufeldt said the biggest difference between the two is that the SAVE plan expands the program to more people, and it changes how people think about interest by preventing interest from piling up.

“In these income-driven plans, like the SAVE plan, if your income is at a certain level, then they are actually saving you money by reducing the monthly payments,” Shufeldt said.

Instead of taking the $10,000 off the loans outright like the original plan, people will still be saving that money, but in the form of having reduced monthly payments. For those who are above the set threshold, this will not mean anything to them, and their payments will continue as regularly scheduled. Those that have already qualified for the REPAYE plan automatically qualify for the SAVE plan, and could be receiving the benefits as early as October.

Shufeldt also discussed potential issues with this plan and said he anticipates conflict along party lines. He said it is especially important for college students to pay attention to this and keep updated in case this applies to them. There are people above the threshold of poverty that Biden set that will see no changes whatsoever in their loan payments, according to Shufeldt, making it even more crucial to double-check whether one could be eligible.

As for UIndy students, Shufeldt advises students to pay attention to the news if they are looking to go to graduate school. He said it is important for students to be having conversations about financial aid in order to make well-informed decisions.

“I would follow the news to pay attention if you are thinking about going to graduate school,” Shufeldt said. “I would encourage students and their families to have conversations with financial aid here and any other kind of trusted financial advisors or sources to make decisions that are best for them.”