President Joe Biden officially announced on Aug. 24 executive action to implement his one-time federal student loan forgiveness plan. Biden said that the program is designed to help those who need it most, especially after the COVID-19 pandemic.

According to the Office of Federal Student Aid of the U.S. Department of Education’s website, the Public Service Loan Forgiveness (PSLF) program may excuse up to $20,000 in student debt if borrowers are eligible.

To be eligible for $10,000 in loan forgiveness, an individual must earn less than $125,000 of income a year, or $250,000 of combined income for married couples. To qualify to receive the max amount of $20,000 in forgiveness, in addition to falling below the income cap, borrowers must have also received Pell Grants in the past, which are government funds given to students exemplifying financial need based off of their input on the Free Application for Federal Student Aid (FAFSA).

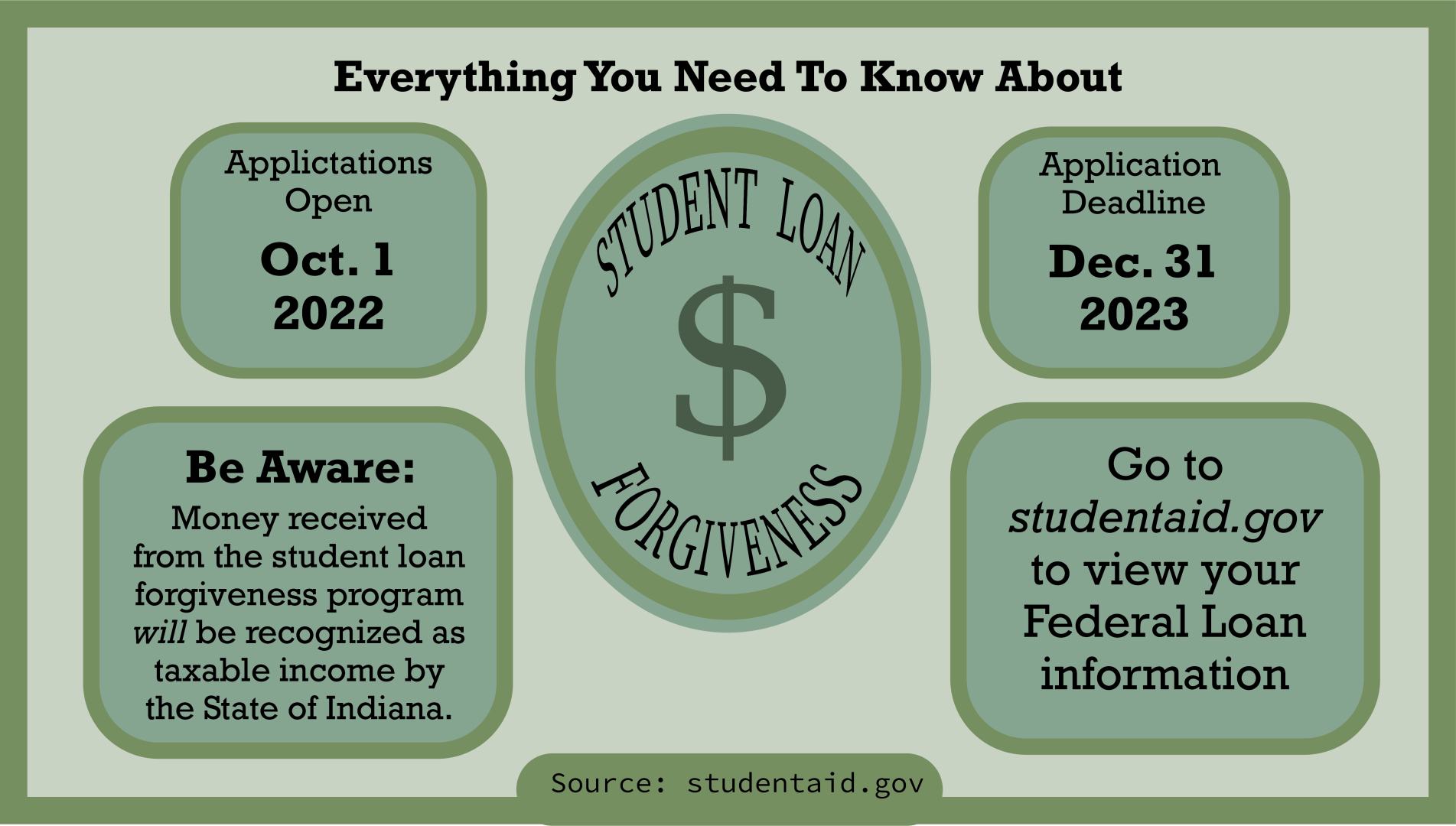

The application form for student loan debt relief will be available at StudentAid.gov in early October.

University of Indianapolis Director of Financial Aid Nathan Lohr said that many students may be eligible. “Part of the plan allows some students to receive their forgiveness automatically, although some students that are eligible may need to submit an application,” Lohr said.

Students may have received automatic loan forgiveness because they filled out the previous year’s (2021-2022) FAFSA. Lohr encourages all of those with federal student loans to fill out the upcoming application. He also recommends that students be aware of who their loan servicers are.

“I would encourage borrowers who may be eligible to reach out to their student loan servicers, so [borrowers] can take advantage of the opportunity,” Lohr said. “Students [should] stay in touch with their student loan servicer and [make sure that the company has their] up-to-date contact information.”

Lohr also said that borrowing students are able to log into their accounts with StudentAid.gov at any time to view their loan information and forgiveness eligibility with the U.S. Department of Education.

The Indiana Department of Revenue will be taxing loan forgiveness as income, according to an article from WTHR. Those who qualify for $10,000 of acquittal will be required when filing 2022’s taxes in April of next year, and those who qualify for $20,000 could owe nearly $650. Indianapolis and other Marion County residents must also pay extra county taxes of $200 to $400. Each respective state has the ability to decide if they will tax student loan forgiveness as income, but the federal government has said they will not, due to Biden’s 2021 American Rescue Plan‘s pause on federal taxes on student loan forgiveness until 2025, according to a fact-sheet posted on the White House’s website.

Extended information regarding the details of the loan forgiveness program can be found by going to StudentAid.gov, clicking on “Manage Loans” and then going to “Qualify for Loan Forgiveness.” The Office of Federal Student Aid is also reachable at 1-800-4-FED-AID.

Federal student loan borrowers should complete their applications by Dec. 31, 2023, according to StudentAid.gov. The pause on repayments, interest accumulation, and collections on defaulted student loans that started in March 2020 will end on Dec. 31, 2022.