According to a U.S. News and World Report, 46 out of 48 states surveyed saw an increase in rent for a one-bedroom apartment from Oct. 2021 to Oct. 2022.

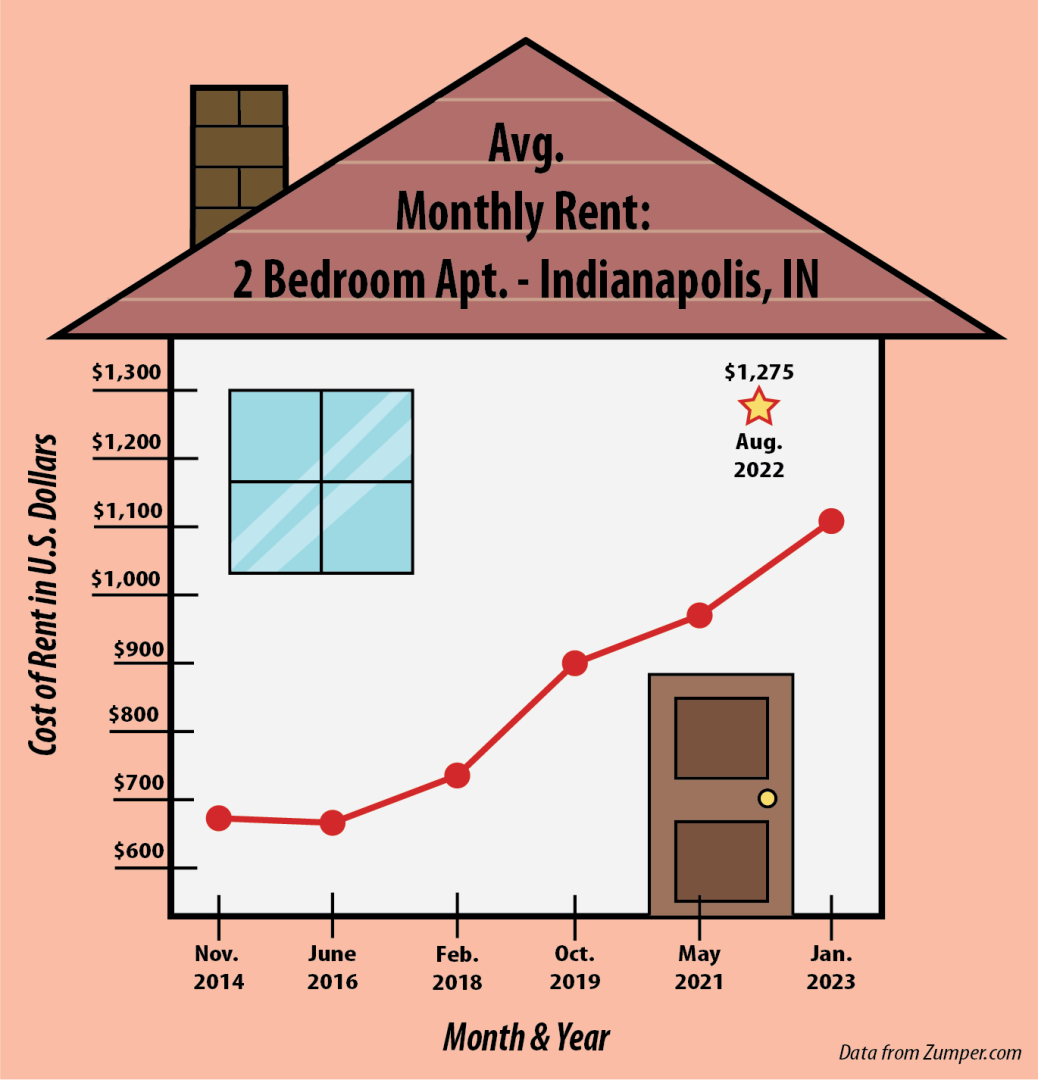

According to Zumper.com, a website that posts available housing and tracks housing prices in the U.S., the average rent for a one-bedroom apartment in Indianapolis is $975 a month, a 2% increase compared to last year. Over the past month, the average rent for a studio apartment increased 13% ($999) with 69 units available in the greater Indianapolis area. According to Zumper, only 25% of one bedroom apartments available are $1,000 or under a month.

According to University of Indianapolis Assistant Professor of Practice at the School of Business Eric Harvey, the current unavailability of affordable housing in Indianapolis is due to a combination of a small supply of housing and stagnant wages.

“An affordable home based on the area median income in Marion County is around $54,000 for a family. That puts them only being able to afford a home under $200,000 total,” Harvey said. “…The average price of a home in the area is [around] $250,000.”

Harvey said even though attempts have been made to produce affordable housing, the supply is still below the demand. According to Harvey, in the past 20 years, wages have not kept up with the rising costs of housing, which also contributes to the crisis.

“When talking about what adds to the inability to buy a home, it starts with wages. Are there enough good jobs that pay enough salary to afford the homes and the rent in the area where you live and work?” Harvey said.

UIndy professor of Economics and Finance Timothy Zimmer said that the rise in working from home has resulted in developers being hesitant about building units in urban areas.

“One of the reasons why we’ve seen kind of a halt in the supply of housing—especially downtown—is some of the home builders are a little worried about where they need to be building their homes,” Zimmer said. “Is it in downtown markets or is it more in the suburb because more people are moving to the suburb to work remotely?”

As a result of the halt in housing development, Indianapolis city planners received a $4.5 million grant from the Biden Administration’s American Rescue Plan, according to WTHR. The funding will go to the Vacant To Vibrant program which will purchase and restore 100 vacant properties in the Indianapolis area. The program aims to turn vacant homes into affordable family housing, according to Indy.gov.

Zimmer said that the grant is a start, but in order for the area to be revitalized, the city will have to invest

in services to encourage people to move in.

“I think it’s a great start, but you have to get buy-ins from the local community, the state government and the local government,” said Zimmer. “Not only do you need the housing, but then you need the services to encourage people to move into those new housing.”

Indianapolis has utilized more than $50 million from American Rescue Plan funding to develop affordable housing and infrastructure to support it, according to WFYI. A report by WFYI said residents who earn 80% of the median Indianapolis income will be offered the new housing once completed. According to Harvey the biggest obstacle in selling housing now is affordability. Modular housing and changes in zoning regulations are the best ways to provide more affordable housing to buyers, Harvey said.

“Modular housing and [changes in] zoning ordinances [to allow] it is our best opportunity to provide more affordable housing,” Harvey said.

According to Zimmer, housing costs are expected to soften over the next year, but market variables make it difficult to make certain.

“Over the next 12 months, there’s some indication that [housing costs] are heading down and interest rates are going up. That’s going to ease some of the demand pressure for new housing, and that’s going to ultimately affect rental rates as well,” Zimmer said. “But again, I say that and then something unexpected happens and it’s really hard to make a prediction on that.”

As of Feb. 2, Rep. Justin Moed (D-Indianapolis) authored a bill that would allow Marion County to set up a system of tax

increment financing (TIF)for housing, according to a recent report by WFYI. Another bill recently proposed will clarify state legislation regarding responsibilities of nonprofit entities that own commercial properties as “Indianapolis has had difficulties holding bad-acting, out-of-state landlords accountable for property neglect,” according to WFYI.

“This housing TIF, instead of capturing the future development of a business property, captures the future development and tax base of residential homes,” WFYI reported Moed said.